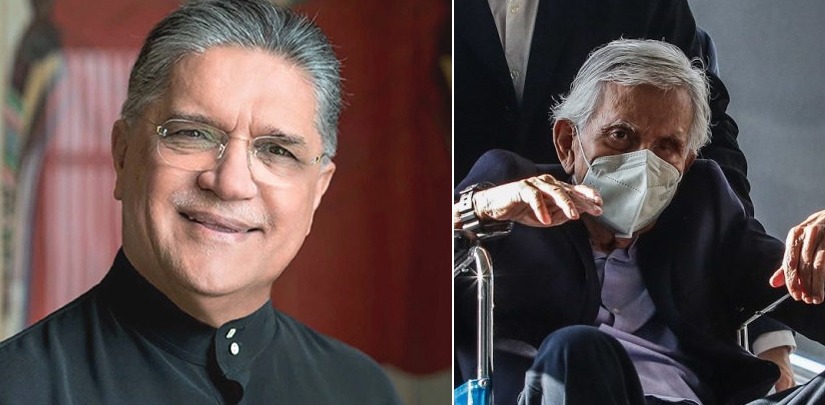

Singaporean businessman and prominent Malaysia property developer Akbar Khan is under investigation on allegations of money laundering and corruption by the Malaysian Anti-Corruption Commission (MACC).

MACC investigators temporarily detained Mr Akbar, who is the main shareholder of high-end developer BRDB Developments Sdn Bhd, for questioning last week after raiding his home and business premise in the capital Kuala Lumpur, senior sources from the agency and lawyers familiar with the situation told CNA.

Apart from freezing the business and personal accounts of the businessman, the MACC also ordered Mr Akbar to declare his assets and the financial holdings of his family, the sources added.

The 83-year-old Mr Akbar declined to comment on the MACC probe when contacted by CNA.

“As this is an ongoing matter, we refrain from commenting on specific details. Our primary focus remains on ensuring a fair investigation,” noted a spokesperson in Mr Akbar’s office.

MACC sources said the businessman is expected to be recalled by the agency for more questioning in the coming days together with other former close associates.

They played crucial roles in the repatriation of frozen shares valued at US$4 billion that were once listed in Singapore’s now-defunct over-the-counter market that traded mainly in Malaysian shares called Central Limit Order Book, or CLOB, and a controversial transaction involving the change of shareholding at conglomerate Multi-Purpose Holdings Bhd (MPHB) in the late 1990s and 2000.

Mr Akbar is the latest in a growing cast of business personalities who have been ensnared in the MACC’s widening investigation on former finance minister Daim Zainuddin.

The probe into Daim’s financial affairs began in May 2023 and is shaping up to be one of Malaysia’s most extensive corporate corruption crackdowns. He was charged on Jan 29 with failing to comply with a notice to declare his assets under the country’s anti-corruption laws.

FRIENDSHIP FORGED WITH DAIM

Mr Akbar, a trained accountant, forged his friendship with Daim in the late 1980s, during Daim’s first stint as finance minister between 1984 and 1991.

But it was during Daim’s second stint as finance minister from early 1999 that Mr Akbar’s commercial fortunes took an upward quantum leap from low-profile medium-sized investments in real estate and luxury goods retailing, into the upper echelons of Malaysia’s corporate scene.

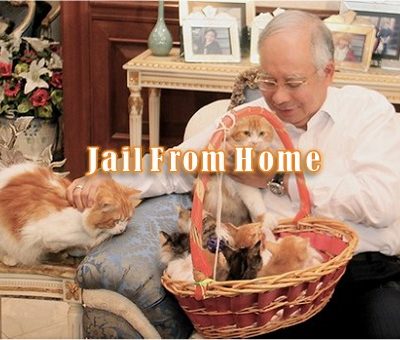

It was a time when Malaysian politics and the economy were in turmoil from the aftershocks of the regional financial crisis that had buffeted several Southeast Asian economies. Then-Prime Minister Dr Mahathir Mohamad had sacked his deputy premier and finance minister Anwar Ibrahim over serious policy differences on how to manage the crisis that was ravaging the businesses of several politically-connected personalities including the then-premier’s own children.

In a bid to shield the domestic economy, the embattled Dr Mahathir implemented several bold and controversial policy counter-measures that provided opportunities to Mr Akbar.

BIG BREAK IN 1999

Mr Akbar’s first big break came in early 1999, when he secured tacit government backing to acquire control of MPHB, a diversified conglomerate that has interests in banking, insurance, property development, and gaming and lottery. The deal immediately attracted controversy for a number of reasons.

Firstly, the transaction was widely seen at the time as a state-led corporate shakedown of businesses owned by those with close ties to deposed deputy premier Mr Anwar, who was sacked by Dr Mahathir in September 1998 and subsequently jailed. Tycoon Lim Thian Kiat, a corporate ally of Mr Anwar’s, was directed by the government to only negotiate with Mr Akbar over the sale of the conglomerate.

Government officials familiar with the ongoing investigation said that the current probe into the MPHB takeover revolves around the convoluted nature of how the deal was structured.

Investigators are particularly interested in how an MPHB unit extended a US$140 million loan to Akbar-linked concerns in the British Virgin Islands, Eightybridge United SA and Strykers Development Inc, that were in turn used to acquire controlling blocks of shares in MPHB from Mr Lim, according to sources.

Malaysia’s corporate law prohibits corporations that own a financial concern to extend loans to related parties. In the Akbar takeover of MPHB, which at the time owned a commercial bank and had an insurance arm, the businessman did not only receive financing from a related party. The loan was also collateralised with MPHB stocks, which is another breach of Malaysia’s corporate law.

While laying the groundwork for his takeover of MPHB, Mr Akbar also secured exclusive – and lucrative – rights from the Daim-led Finance Ministry at the time to handle the repatriation of frozen shares valued at over US$4 billion that were listed on CLOB.

The equities in 112 Malaysian companies were frozen when Malaysia imposed capital controls in September 1998 to protect its battered currency. After months of government-to-government negotiations, Mr Akbar’s privately owned Effective Capital was appointed to arrange the transfer of the frozen shares back to the Malaysian exchange.

Government officials noted that under the arrangement, Effective Capital is estimated to have grossed almost RM300 million to return the CLOB shares to over 172,000 investors.

OTHER PROMINENT BUSINESSMEN SUMMONED, AUDITED

Days before Mr Akbar was temporarily detained for questioning, the MACC summoned another one-time Daim business acolyte, Tajudin Ramli.

Mr Tajudin, who previously had a controlling interest in national carrier Malaysian Airline System (MAS), was grilled by MACC investigators over a controversial plan by the government in early 2000 to bail out the airline.

MACC sources told CNA that the agency is investigating whether there were elements of corruption in the transaction, which was actively promoted by Daim.

Daim had convinced then-Prime Minister Mahathir Mohamad’s government to pay Mr Tajudin RM1.79 billion, or RM8 per share, for his controlling stake. At the time, the national carrier’s stock was trading at around RM3 apiece, which put the value of the businessman’s equity holding at roughly RM718 million.

Mr Tajudin, who has largely withdrawn from Malaysia’s corporate scene, could not be reached for comment.

The MACC’s investigations have also led to separate, but related, audits of the dealings of other businessmen such as Mr Halim Saad, who served as the chief corporate nominee for the United Malays National Organisation (UMNO) political party, and Mr Tan Hua Choon, a low-profile tycoon who controls a concession to manage and maintain the government’s fleet of motor vehicles valued at over RM4.5 billion (just under US$1 billion).

Mr Daim was UMNO’s longest serving treasurer. Under his watch as both purse-keeper of the party and the country’s finance minister, the Halim-controlled conglomerate Renong Bhd emerged as the main beneficiary of government contracts worth billions of ringgit, including the construction of the 772km North-South Highway that runs the length of Peninsular Malaysia and other infrastructure undertakings.

It was also during Daim’s stint as finance minister that Mr Tan, who enjoyed close ties with the politician, won the lucrative concession to operate and manage the government’s vehicle fleet. Both Mr Halim and Mr Tan could not be immediately reached for comment.

Source : Channel News Asia

Source : Low Yatt : https://forum.lowyat.net/topic/5445780

The Coverage Malaysia