Introduction

Most people are good at telling you where the money’s at – whether it’s at the bank, the stock market, real estate or the newest start up venture. But knowing where to get your money is only half of the equation. The other half is understanding how to go out and get it.

Making money has never been easier, especially with the rise of the internet and all its media platforms.

The Difference Between Wealth and Income

For starters, it is very important to distinguish between making a million dollars and having a million dollars. While having an accumulated net wealth of over $1 million is an attainable goal for most people, only a very select few will ever earn that much in a single year. Moreover, “earning” a million-dollar paycheck may not leave someone as rich as commonly thought—recent history abounds with examples of athletes, entertainers, businessmen, and lottery winners squandering their money by throwing away unthinkable amounts of money on frivolities.

It is also worth noting that there are many “million-dollar earners” who do not actually earn $1 million. Someone may own a business that brings $1 million in revenue, but has to pay most of that out in expenses.

Hard to Get Started

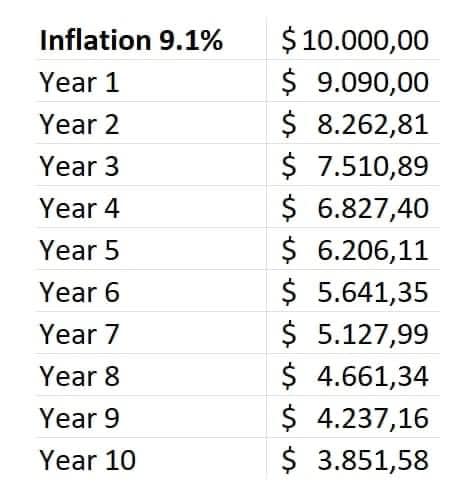

One of the biggest obstacles to having $1 million in the bank is the slow rate at which people save early in life. While some jobs do offer starting salaries in excess of $60,000, they are the exception. More often, new graduates are scraping by to pay the rent, repay student loans, and still put together enough to have some semblance of a life. Even for those highly disciplined few who can save $10,000 or $15,000 a year, that would take over 66 years to build $1 million with no interest or compounding.

One of the reasons that the first $1 million is so hard is that it is such a large amount of money relative to where most people begin. To go from $500,000 in assets to $1 million requires a 100% return—a level of performance very hard to achieve in less than six years. To go from $1 million to $2 million likewise requires 100% growth, but the next million after that requires only 50% growth (and then 33% and so on).

Mathematically, $1MM is a 100000000% increase over a base of $1, but $2MM in only a 100% increase over $1MM — much easier.

It’s true that it’s easier for the rich to get richer. That first million is by far the toughest to make. But once you’re there, it gets much easier to make the next million.

When you already have money working for you, each percent of return adds more to your worth. Earning 10% on $10,000 gives you $1,000. Making 10% on $1,000,000 gives you $100,000.

If you take $19,000 every year, invest it and can generate 6% p.a. on your investments, it will take roughly 25 years to reach $1 million dollars.

Assuming you still only deposit $19,000 p.a. from your earned income, and you let the earnings on $1 million dollars compound, it would take roughly 10 years to get your second million.

So, as you can see, using the same assumptions, it took 25 years to get your first million and only 10 years to get your second million. Can you guess how many years it would take to get your third million? Roughly 6 years.

The psychological reasons why earning your first million is the hardest

Most people have doubts, fears, and an overall lack of belief about earning money before they’ve done it. Once you’ve achieved something unusual, the doubt, fear, and worry disappear.

The subsequent millions are earned far faster than the first million because you no longer have any hesitation in your mind or actions. It’s a direct route to financial success when you eliminate any form of psychological interference.

The mental and emotional strength gained during the fight for your first million becomes a true asset in the fight for the next million. Feelings of success feed on themselves and grow stronger and stronger. Using your newfound mental strength, the momentum continues to build and turns into an emotional tidal wave, making the money that much easier to earn.

The first million raises your awareness of what it truly takes to earn that kind of money, as well as the realization that higher levels of awareness in this area exist.

Once you have proven to yourself that you can earn that first million, the potential for more is endless. There is a confidence and a calm that comes after that first million. Once you’ve done it before, you are 100% sure you can do it again.

Neuro-association- After making your first million, you begin to see your dreams as possibilities, and not just a wistful fantasy.

Money Makes Money

Furthermore, money makes money, and the money made from money already in the bank is taxed at a much lower rate than money made from work. This is why the rich seem to get richer, while everyone else is trying to crack the ceiling.

Money is a slave of the rich and a master of the poor

Money is a slave of the rich and a master of the poor. Whereas a rich man uses money to make more money, a poor man works hard to make money. Money is a good worker and if the environment is conducive, it works harder and longer and bears much fruit. On the contrary, a human gets tired after some time, bears less fruit and amounts to little. The best, quicker and lasting way to make a fortune is to have money work for you.

Salary vs Net Worth

The poor concentrate on getting a promotion and a higher salary but the rich pay attention to increasing their net worth.

Earning your salary is the beginning. You work hard to make that money. Use that as “seed” money to work harder for you to earn more money. How? Invest. Not saving. Saving would not develop wealth. Investment will.

Your value is determined by what you make of yourself

A bar of iron can be worth $5 but if made in horse shoes it can be worth $12,made into needles can cost $3,000 made for balance spring for watches it can be Worth Over $300, 000.

Your value is determined by what you make of yourself. If you think of yourself low, that is how everyone else will treat you. If you don’t put value on yourself, the world will put value on you and it won’t be much. You are valuable !

Apakah Nilai Anda ?

Mindset

Want to be financially successful?

It starts with a producer mindset: Instead of buying products, sell products.

Instead of buying services, offer services.

Instead of taking a class, offer a class. Instead of borrowing money, lend it.

Instead of taking a job, hire for jobs become an entrepreneur.

Instead of renting a house, offer rentals.

Instead of investing in public, invest for ownership.

Consumers become poor while producers become financially successful.

Inflation

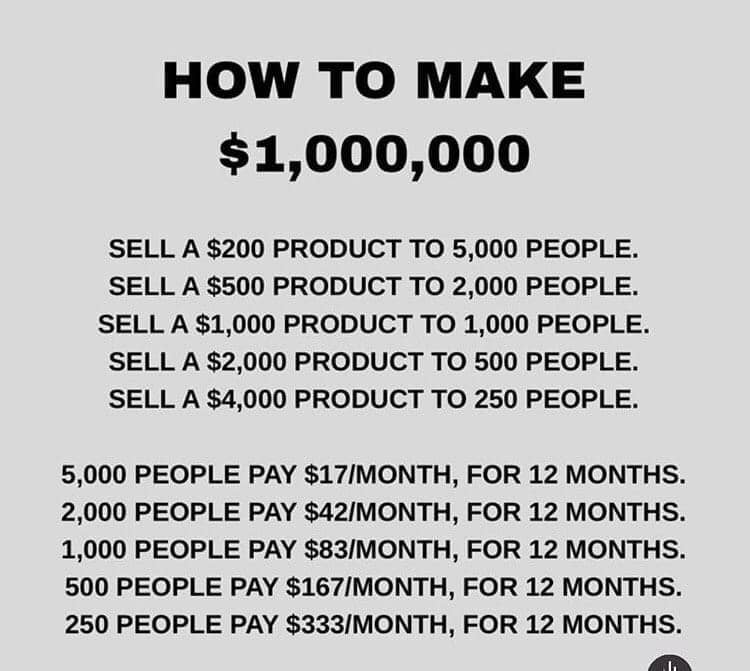

How To Make RM 1 Million ?

Put Your Money To Work

Adakah Anda Tahu Apa Yang Bank Buat Dengan Wang Simpanan Yang Anda Simpan Dalam Akaun Mereka ?

Mereka Melabur Wang Tersebut Dan Memberi Pulangan Sebanyak 0.0001% Daripada Keuntungan Tersebut Kepada Anda !

” They’re Doing What You Should Be Doing ! Investing It ! “

” When You Don’t Know The Rules Of The Game , You Get Played “

Jika Anda Tidak Belajar Untuk Melabur Wang Sendiri Maka Orang Lain Pula Akan Melabur Wang Tersebut Yang Sepatutnya Milik Anda ! Anda Kena Belajar Untuk Put Your Money To Work !

Time Investment

Time is money. Waste it and it is gone forever.

“Time is money”, “Time is your most valuable resource!”. You have heard about these, right? But yet many working adults waste time on matters that don’t bring them any closer to their financial goals.

Are you spending your day on things that matter to you?

To the rich, time is worth much more than money. The rich would not hesitate to buy time but the poor don’t appreciate and waste time. And yet, the poor always complain that there is not enough time.

Time is an investment and where you invest your Time is where you will get your returns. Imagine investing your time in friends whose only achievement is the growth in years? Well I don’t know if that qualifiers to be called an achievement.

Friendship is determined by who you are becoming not what you have been. If your friendship is not helping you develop in one way or the other then it’s high time you asked yourself if you really need it because the truth is you will never go beyond the friendships you interact with.

Remember Iron sharpens Irons. you cannot be different from those you closely associate with. Someone once said “I used to think making $10,000 a month was impossible until I met someone who makes $100, 000 a month then making $10,000 become easy”. Hang out with people who help you achieve your goals not crush them

Success is contagious so is poverty. The easiest way to catch a flue is by hanging around someone who has a flue. A drowning man will pull you down together with him. The type of people you sorround yourself with play a great role in determining what you get in life.

If you want to succeed in an endeavor, associate yourself with people who are already Successful in that endeavour. Warren Buffett once said ” it’s better to hang out with people better than you. Pick out associates whose behaviour is better than yours and you will drift in that direction”.

Source : MYPF

The Connection Between Money and Problem-Solving: Why Money is Found Where There’s a Problem”

Money is a vital resource that is essential for our day-to-day lives. It is used to purchase goods and services, pay bills, and invest in the future. However, it’s important to recognize that money isn’t just a static commodity that is sitting around waiting to be spent – it is constantly flowing and shifting, and it tends to follow areas of need and demand.

One way to think about this concept is to consider the phrase, “money is found where there’s a problem.” When there is a problem that needs to be solved, whether it’s a personal issue, a business challenge, or a societal crisis, people are willing to pay for solutions that can address that problem. This creates a market for products, services, and expertise that can provide those solutions, and that market is where money tends to flow.

For example, let’s say that there is a widespread problem with air pollution in a particular city. This problem is affecting the health and well-being of the residents, and there is a strong demand for solutions that can reduce the pollution levels. Companies that specialize in clean energy technologies, such as solar panels or wind turbines, may see a surge in demand for their products and services as people look for ways to reduce their carbon footprint. Investors may also see opportunities in these companies, and may be willing to invest money in their development and growth.

Similarly, when there is a problem with a particular industry or market, there may be opportunities for entrepreneurs and investors to create new products or services that can address that problem. For example, the rise of e-commerce was largely driven by the problems that people had with traditional brick-and-mortar retail stores, such as limited selection and inconvenient store hours. By creating a solution to these problems, online retailers were able to capture a significant portion of the market and generate substantial revenue.

Overall, the connection between money and problem-solving is clear. When there is a problem that needs to be addressed, people are willing to pay for solutions, and this creates opportunities for businesses and investors to generate income and profit.

Money Follows Mastery: The Importance of Developing Expertise in Achieving Financial Success

The phrase “money follows mastery” refers to the idea that financial success often comes as a result of mastering a particular skill or area of expertise. In other words, when you become really good at something, people are willing to pay you for your services, and you are more likely to achieve financial abundance.

This principle can be applied to a variety of fields, from business and entrepreneurship to sports and the arts. For example, a skilled entrepreneur who has a deep understanding of their industry is more likely to create a successful business that generates substantial income. Similarly, an athlete who has honed their craft and become one of the best in their sport can command high salaries and endorsement deals.

On the other hand, people who lack expertise or skills in a particular area are less likely to achieve financial success. Without mastery, they may struggle to find well-paying jobs or may be limited in their ability to start their own businesses.

Therefore, if you want to achieve financial success, it is essential to focus on developing your skills and expertise in a particular field. This may involve pursuing advanced education, seeking out mentorship and training opportunities, and dedicating time and effort to mastering your craft. By doing so, you will be more likely to attract opportunities, clients, and financial rewards that come with being an expert in your field.

“0.01% Of Wealth” Rule

0.01% is a good proxy for what constitutes a trivial amount of money for any level of wealth. For example, if you had a net worth of $10,000, paying $1 more (or 0.01% more) for something shouldn’t affect your finances in the slightest.

We can use this 0.01% threshold as a guide to then re-think Butterfield’s “Three Levels of Wealth” to include other lifestyle adjustments:

Level 1. Paycheck-to-paycheck: You are conscious of every dollar you spend. This includes people with crippling debt.

Level 2. Grocery freedom: How much specific grocery items cost don’t impact your finances.

Level 3. Restaurant freedom: You eat what you want at restaurants regardless of the cost.

Level 4. Travel freedom: You travel when you want, how you want, and stay where you want.

Level 5. House freedom: You can afford your dream home.

Level 6. Philanthropic freedom: You can give away money that has a profound impact on others.

Due to the diversity of life circumstances, it can be difficult to put an exact dollar amount on each of the above wealth levels. For example, a single 21 year-old with $1 million is very different than a 65 year-old retired couple with $1 million.

However, if we use the 0.01% threshold as a guide, a working-age adult could use the following amounts to determine their wealth level (note: the x-axis is a log scale):

Let’s say you are at the grocery store and you are deciding whether to purchase a dozen eggs for $1.99 or a dozen cage-free eggs for $2.99.

If your net worth was $1,000, this single choice (paying $1 extra for cage-free eggs) could have a slight impact on your finances as it would represent 0.1% of your total assets. However, if you were worth $10,000 (or more) the decision to spend $1 more would likely be trivial to your finances since it represents less than 0.01% of your wealth.

Nevertheless, we can extend this thinking to more expensive spending categories as well. For example, imagine you are in a restaurant where you are deciding between a burger for $15 and salmon for $25. If your net worth > $100,000 then the $10 difference is trivial (<0.01% of net worth). If you continue to scale this logic upward you will see that the marginal impact of a single decision within each level of wealth could be as follows:

Level 1. Paycheck-to-paycheck: $0-$0.99 per decision

Level 2. Grocery freedom: $1-$9 per decision

Level 3. Restaurant freedom: $10-$99 per decision

Level 4. Travel freedom: $100-$999 per decision

Level 5. House freedom: $1,000-$9,999 per decision

Level 6. Philanthropic freedom: $10,000+ per decision.

When you view wealth in this way, it looks more like steps than a smooth, ever-increasing line. This is because most people in the same level of wealth consume in much the same way. If you are in level 3, you don’t fly private and you only fly first class if you are lucky enough to get upgraded. If you are in level 1, you rarely fly.

More importantly though, the best way to climb the wealth ladder is to spend money according to your level. If you are in level 1 and you book a vacation without caring about the costs (level 4), then you won’t progress further up the ladder. Until you have the money to spend frivolously within a level, you have to be strict about your spending in that level. Get this right and you have a far better chance of progressing up the ladder.

Source : Off Dollar Data

If you’re going to save money, do it while imagining all the good that could come

Which of the following would motivate you to put more money aside?

Option A: A luxurious stay at the Four Seasons Sayan is paired with a first-class flight to Bali, complete with lie-flat chairs. The package includes a gourmet dinner, excellent accommodation, and a choice of spa treatments.

Option B: Money to be invested in a diversified portfolio and multiplied tax-efficiently. Increasing your net worth, which can be used to cover future costs.

Option B can be utilised to help pay for Option A.

If you understand why you’re saving money, you’re more likely to stick with it and meet whatever financial goals you establish. Could a change in your money mindset assist you in achieving your financial objectives more quickly and easily?

MYVI vs EMAS

Harga sebuah Myvi tahun 2000 = RM40,000

Hara sekilo emas tahun 2000 = RM40,000

Harga sekilo emas tahun 2000 = RM40,000

Harga sekilo emas tahun 2021 = RM246,000

Tahun 2000, 1kg emas boleh membeli sebuah Myvi.

Tahun ini, 1kg emas boleh membeli 5 buah kereta Myvi.

Kalau anda ada duit lebih, anda mahu upgrade kereta ataupun mahu beli emas sebagai simpanan?

The Power of Mindset: How Your Mindset Determines Your Level of Achievement

Your mindset is the set of beliefs and attitudes that you hold about yourself and the world around you. It plays a critical role in determining your level of achievement. Your mindset can either limit you or propel you toward success.

A growth mindset, for example, is one where you believe that your abilities and intelligence can be developed through hard work and perseverance. With a growth mindset, you see challenges as opportunities for growth and learning, and failures as valuable lessons. This mindset fosters resilience and a willingness to take risks, which can lead to greater success.

If you can’t manage $10 , you can’t manage $1000?

On the other hand, a fixed mindset is one where you believe that your abilities and intelligence are fixed traits that cannot be changed. With a fixed mindset, you may avoid challenges for fear of failure, and view setbacks as evidence of your limitations. This mindset can hold you back from reaching your full potential.

Did you know that if you can’t manage $10 , you can’t manage $1000? Life is a process and stages are not to be skipped. If you fail to multiply that $10, how are you now going to multiply $1000?

The Coverage Malaysia