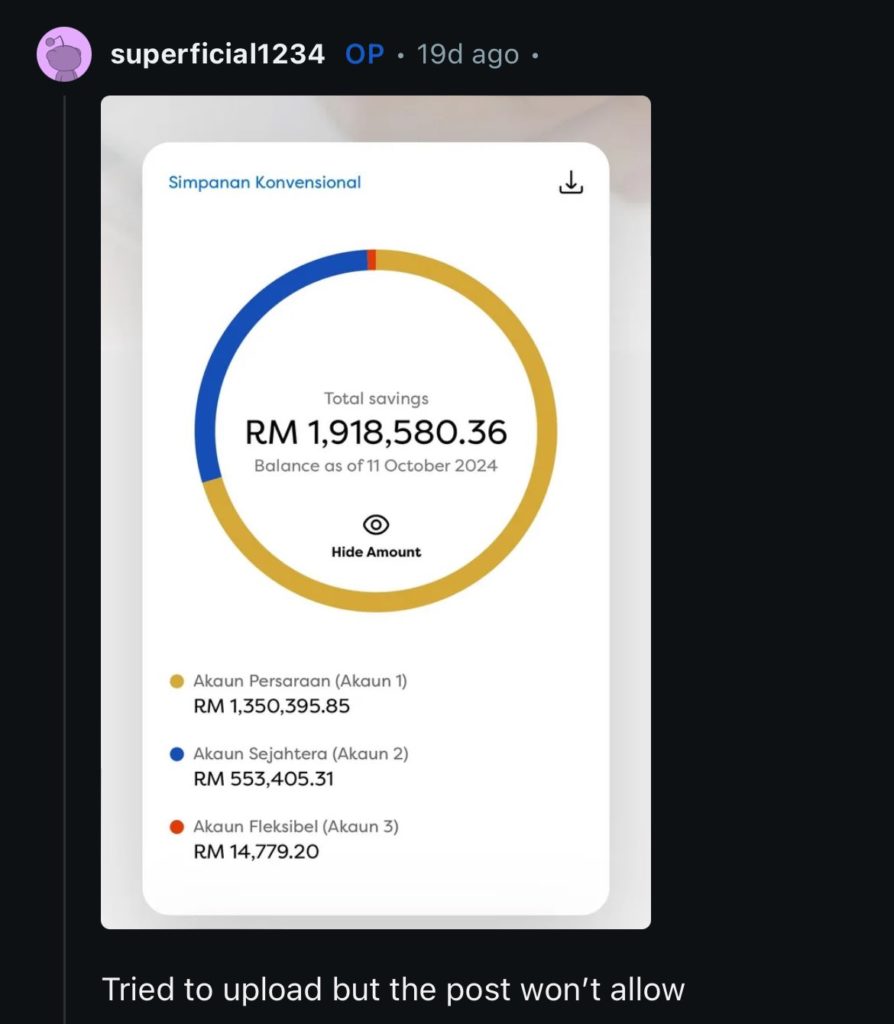

A 35-year-old Malaysian woman has caused a stir online after revealing that her EPF (Employees Provident Fund) savings are on the brink of reaching RM2 million.

Her financial journey and the strategies she shared have sparked widespread discussion, with many netizens eager to learn from her disciplined approach.

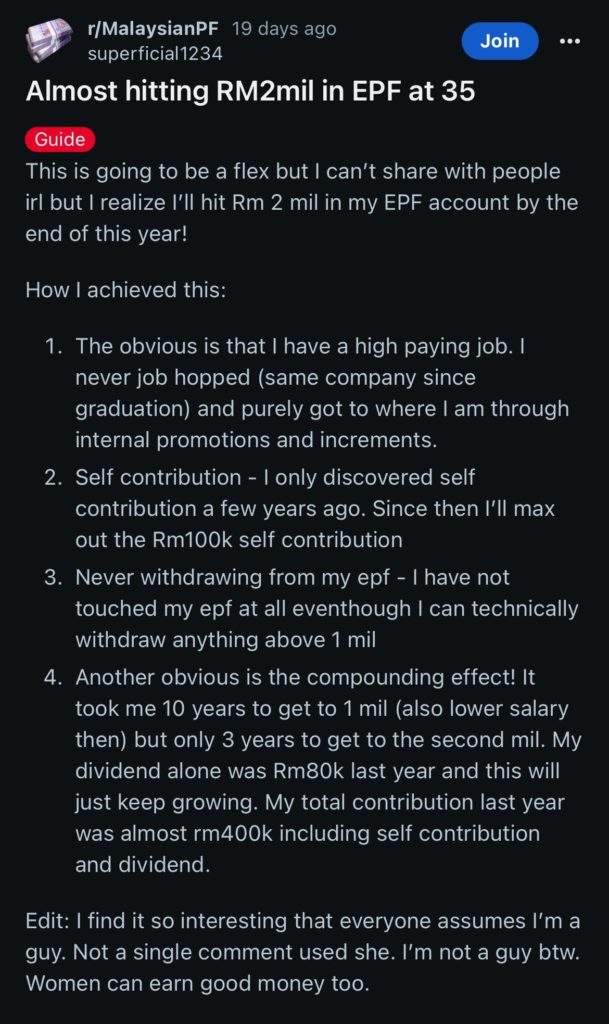

n a social media post, the woman shared that her financial success is largely due to three main practices: consistency in contributions, letting compound interest work its magic, and receiving promotions and increments within the same company.

She held a well-paying job and chose to grow within her company, advancing through internal promotions and regular salary increments rather than job-hopping.

Maximizing self-contributions

A few years ago, she discovered the option of self-contributing to her EPF and decided to make the most of it.

Since then, she has been contributing the maximum annual amount of RM100,000, supplementing her employer’s contributions to significantly grow her retirement savings.

This strategy, paired with her decision to avoid withdrawals even when her savings exceeded RM1 million, allowed her EPF balance to grow steadily.

What set her savings apart was the compounding effect.

While it took her a decade to reach her first RM1 million, she managed to nearly double that amount in just three additional years.

Last year alone, her dividend earnings reached RM80,000, pushing her total contributions—including self-contributions and dividends—to almost RM400,000.

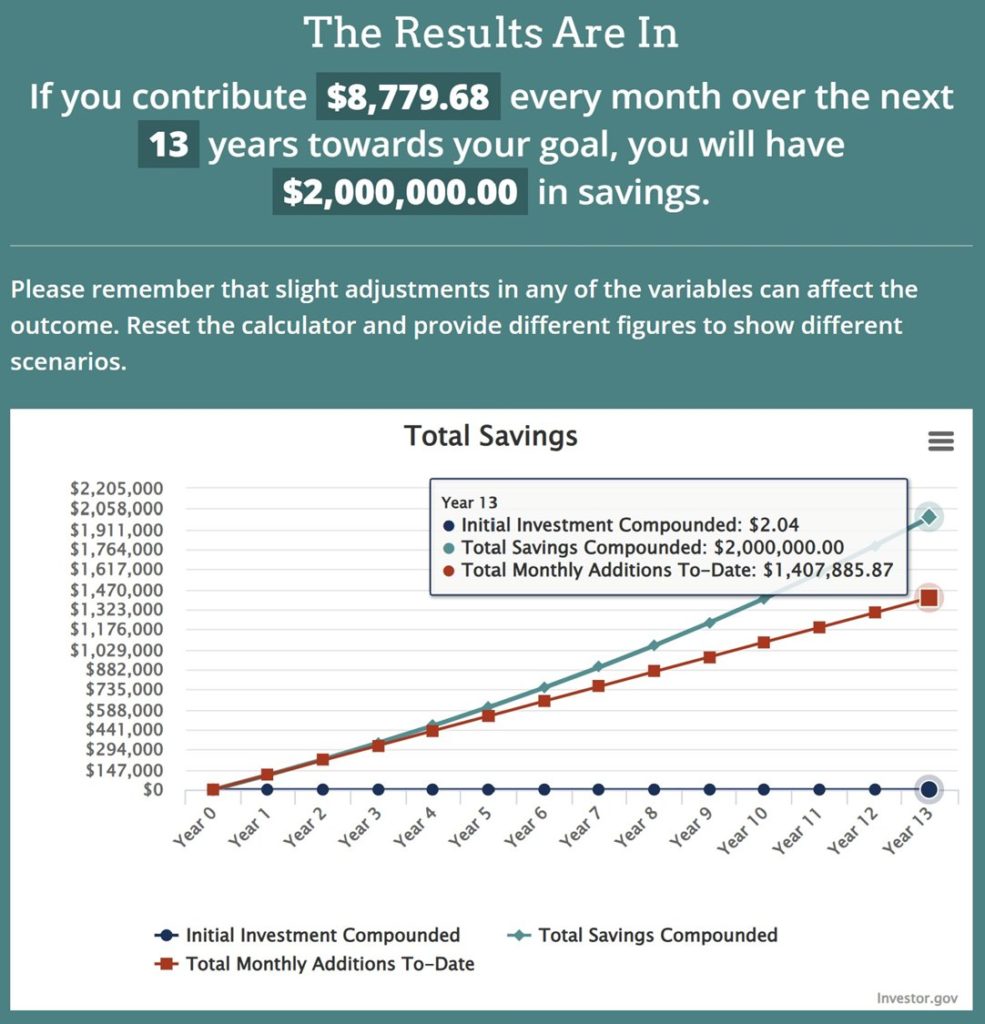

So how much did this person contribute to EPF every month? And most importantly, how much does she earn, actually? We can work the math backwards.

Assuming she started working at 22, she (and her employer) would need to contribute RM8,779.68/mo to EPF. Relying on mandatory contributions (11% employee + 12% employer), her average salary is: RM8779.68/0.23 = RM38,172.52 We will never know how much her starting pay was, but hopefully this will give you a better idea on how much she is earning on average.

Also, she said that it took her 10 years to reach her first RM1 mil, but only 3 years to hit the next RM1 mil. If she continues this contribution, her third million will only take 2 years (maybe lesser). Obviously, no one starts their pay at RM38k. So we can fairly assume that her starting pay is already 5 digits (~RM10k), and her salary in the past 5 years (leading up to 35) is RM50-60k.

As for voluntarily contributions, she mentioned that she maxed out RM100k/yr to EPF in the last few years. That’s RM8,333.33 every month. If we include this, then her average salary should range somewhere between RM20k to RM30k.

Not everyone starts work at 22. Some don’t start working until 24 or maybe 26. In this case, if she started working at 24, her average salary would need to be RM47,951. Start work at 26: RM62,231.

Source : The Futurizts

The Coverage Malaysia