As the country’s population ages, there are concerns whether Malaysia can keep up with its pension payment obligations to government retirees.

Presently, the federal government’s public pension liability stands at nearly RM32 billion, accounting for more than 10% of its projected 2024 operating expenditure (opex) of RM303.8 billion.

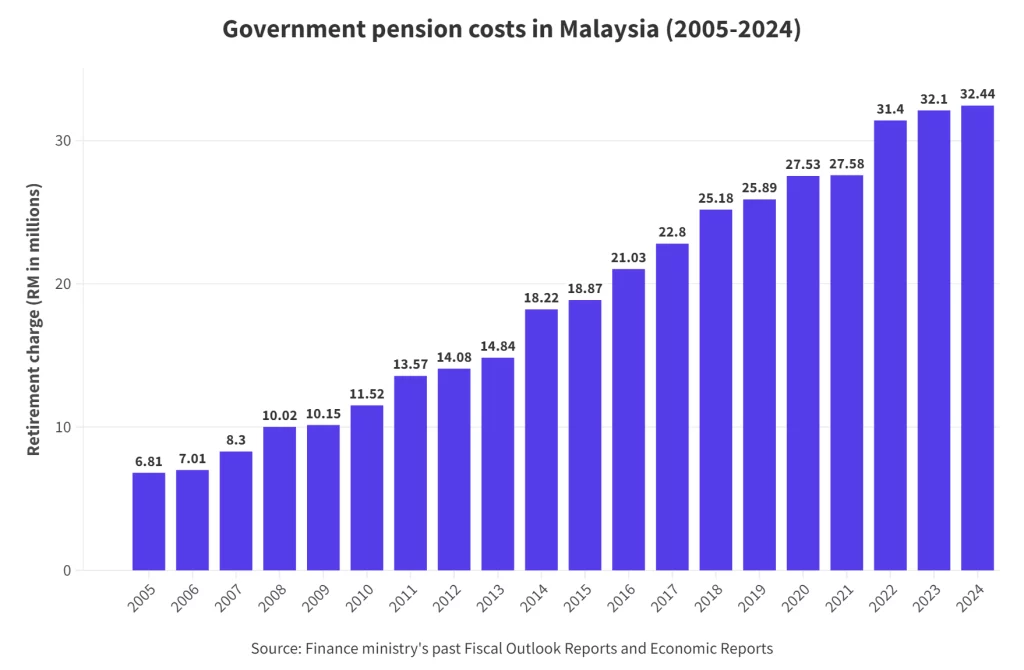

FMT’s analysis of data over the past 20 years revealed a five-fold increase in annual retirement charges, surging from RM6 billion in 2005 to RM32 billion this year.

Between 2005 and 2015, pension costs doubled to nearly RM18.87 billion, with the biggest annual jump (RM3.38 billion) taking place between 2013 (RM14.84 billion) and 2014 (RM18.22 billion).

By 2016, government pensions and related costs surpassed the RM20 billion mark. Six years later, in 2022, it breached the RM30 billion mark.

On average, pension costs have escalated by RM5.65 billion every five years. This pattern hints at a potential breach of the RM40 billion mark by 2030.

Pensions as a proportion of opex

For most of the past decade, almost half of the opex has gone towards paying the wages of civil servants and meeting pension obligations to government retirees.

Pension and related costs tended to hover at around 6% to 7% of opex in the earlier years, but steadily increased over time, hitting 10% in 2016 and staying at that level ever since.

The combined expenditure of pension and wages exceeded 40% of the government’s opex in 2015 and continued climbing in the following years, but took a slight dip in 2019. The figure skyrocketed to 49.2% and 49.7% of opex in 2020 and 2021, respectively.

Since 2010, the government has also been giving special cash assistance to pensioners on an annual basis, initially at RM500 each, but later at RM250 per person.

The salary schemes of civil servants have also been revised on several occasions. Pensions for retirees are calculated based on their length of service and their last drawn salary.

How many government retirees are there?

Official figures on the number of government retirees are hard to find. However, according to the finance ministry’s annual economic reports, there were 590,000 retirees in 2010. This increased to about 853,000 by 2020.

In 2023, the finance ministry’s fiscal outlook report estimated that there were over 921,500 retirees, with the number projected to grow to 936,000 this year.

This increase is linked to the growth of the civil service workforce, which has gone from 1.24 million in 2010 to 1.6 million in recent years.

Can the government sustain pension payments?

With more civil servants set to retire in the future, will the government be able to set aside enough funds to meet all future pension payments?

Economist Yeah Kim Leng of Sunway University said allowing retirement charges to grow too rapidly could overwhelm the government’s financial capacity.

To accommodate larger allocations for pensions, Yeah said, the government would either have to explore avenues to augment its revenue streams or reallocate a larger portion from its fixed revenue pool.

He said the second option would entail “some form of cutbacks in other sectors of the economy, especially health, education and even military spending”.

Trimming the service and moving away from pensions?

On Jan 24, deputy prime minister Ahmad Zahid Hamidi announced that new civil servants would no longer be entitled to pension payments. Instead, they will be required to contribute to EPF and the Social Security Organisation (Socso).

Yeah, who also serves as an adviser to the finance ministry, said this was the widely advocated “defined contribution scheme” under which employees would contribute 9%, and employers 11% or higher.

He suggested that the shift should be gradual with a stepwise contribution process to ease employees into the new system.

“That can be coupled with some kind of a gratuity or other benefits to make it more attractive for those joining the government so that the benefits are comparable to what they would receive if they are in the private sector.

“Equitable benefits, irrespective of where you’re working, are very important from an employee’s perspective because we do not want those joining the government service to be worse off in terms of the pension retirement schemes available to them,” he said.

Meanwhile, civil service union Cuepacs rejected the call to abolish pension schemes, citing low salaries despite decades of service.

“EPF will not guarantee the future of retirees. Cuepacs hopes that the government will reconsider and seek input from us and labour unions,” its secretary-general, Abdul Rahman Mohd Nordin, told FMT.

Trimming the civil service is another way to mitigate future pension liabilities, but Yeah said it may come with economical and societal implications.

“Downsizing will have a negative impact on the economy because you have more unemployed (people), so you would have the challenge of creating jobs for the new graduates and those entering the workforce,” he said.

Source : FMT

The Coverage Malaysia