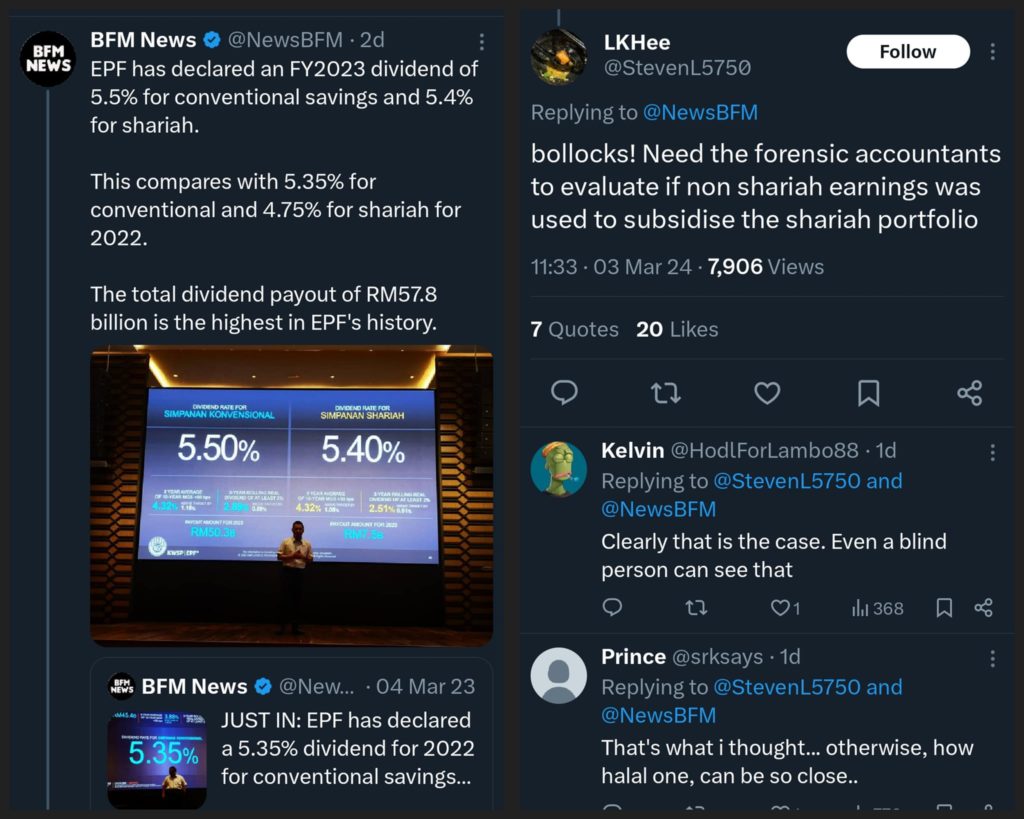

EMPLOYEES Provident Fund (EPF) declares a 5.5% dividend for conventional savings in 2023, totalling RM50.3 bil payout, up from 5.35% in 2022. Shariah savings are at 5.4%, RM7.5 bil payout. However, the total dividend payout of RM57.8 bil is the highest in EPF’s history.

But many of those who have their savings with the EPF say they are disappointed with the dividends, as they expected a better percentage.

Some users on the X platform are saying the EPF board should divest from their current investment portfolio to focus on US ETFs, for example. They believe these will reap better benefits for EPF account holders.

Others are saying individuals who invest in some stocks, like Maybank will probably get a 7% return, showing disbelief that EPF could only pull 5.5%.

Meanwhile, some netizens on X are asking why there are two types of EPF savings, the conventional and the Shariah, arguing that the conventional is the one pumping the funds into the Shariah savings.

Source : Focus

Consider additional dividends for conventional savings

Gerakan has urged the Employees Provident Fund (EPF) to consider giving an additional 0.5 per cent to one per cent dividend to members in a bid to encourage them to continue to save with the agency.

Its deputy president Oh Tong Keong said the economy was on a decline under the unity government and as such, he claimed the working class, which was hoping for higher dividends, was disappointed with EPF’s recent dividend announcement.

On Sunday, EPF announced that it would pay out a 5.5 per cent dividend for conventional savings and 5.4 per cent for syariah savings for 2023. This translated to a total payout of RM57.81 billion for 2023.

Oh said EPF had last year announced a 5.35 per cent dividend for 2022, the lowest in 14 years.

“This time around, they announced 5.5 per cent dividend for conventional savings for 2023, a mere 0.15 per cent increase.

“This is most disappointing. Many EPF members were hoping that the agency would announce a dividend of more than six per cent.

“As such, to encourage members to increase their savings and reduce early withdrawals, the government and EPF must be more generous in their dividends to stabilise members’ savings for the future,” he said.

Oh said more people, particularly senior citizens who have reached the required age to withdraw their savings, might be willing to keep their savings with EPF if they expected higher dividends compared to other financial agencies, for example bank fixed deposits and investments in trust funds.

However, he said the contrary might happen if the dividends were lower than those offered by other financial agencies.

“With that, we hope EPF can consider the factors raised, that will influence members to keep saving in fund.

“EPF should consider giving an additional dividend of 0.5 per cent or one per cent to its members if they earn large profits from foreign and local investments,” he added.

Source : NST

The Coverage Malaysia